SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx☒

Filed by a Party other than the Registrant☐¨

| Preliminary Proxy |

| Confidential, for |

| Definitive Proxy |

| Definitive Additional |

| Soliciting Material Pursuant to |

The Torray Fund

, that has no material differences from the operating expense limitation agreement in effect when the Sale Transactions occurred (“Prior OELA”); the New OELA will go into effect if and when the New Management Agreement is approved by shareholders;Inin Its Charter)x☒No fee required. ¨☐Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. Title of each class of securities to which transaction applies: Aggregate number of securities to which transaction applies: Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-110‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): Proposed maximum aggregate value of transaction: Total fee paid: ☐ ¨materials.materials:¨☐Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. Amount Previously Paid: Form, Schedule or Registration Statement No.: (3)Filing Party: (1) (2) (4)Date Filed:Q.

Why am I receiving this proxy statement?A. Q. Why am I being asked to approve the New Management Agreement? A. Q. What actions did the Fund’s Board take during its September 22, 2021 Board Meeting relating to the anticipated Sale Transactions? A. THE TORRAY FUND(“Trust”Trust that has no material differences from the Prior Management Agreement; the New Management Agreement is subject to shareholder approval;7501 Wisconsin AvenueSuite 1100 Bethesda, Maryland 20814(800) 443-30362005Dear Shareholder:On behalf2021 and are scheduled to expire on the earlier of the following dates: (1) the date that shareholders approve the New Management Agreement, and such results are certified; or (2) on February 27, 2022, which is 150 days after the Sale Transactions were consummated. If shareholders do not approve the New Management Agreement before February 27, 2022, the Fund will not have an effective advisory agreement in place as of February 28, 2022, and Torray would not be authorized to continue to provide such services to the Fund. Your vote to approve the New Management Agreement is consequently extremely important.Q. What will happen if shareholders do not approve the New Management Agreement before the Interim Management Agreement expires? A. Q. What ownership changes resulted from the Sale Transactions? A. Q. Why did Mr. Haffenreffer leave Torray, and how will his departure affect the Management of the Fund and the management of Torray? Q. How does this proxy vote to approve a New Management Agreement relate to the proxy vote to approve a new management agreement that occurred earlier this year? A. Q. How will these events affect my account with the Fund? A. Q. How will my approval of the New Management Agreement affect the management and operation of the Fund? A. Q. How will approval of the New Management Agreement affect the fees and expenses I pay as a shareholder of the Fund? A. Q. Are there any material differences between the Fund’s Prior Management Agreement with Torray, the Interim Management Agreement and the New Management Agreement? A. Q. Are there any material differences between the Prior Operating Expense Limitation Agreement, the Interim Operating Expense Limitation Agreement, and the New Operating Expense Limitation Agreement? A. Q. How does the Trust’s Board of Trustees recommend that I vote? A. After careful consideration, the Board, including its Independent Trustees voting separately, having determined that the proposal is in the best interest of the Fund and its shareholders, unanimously recommends that shareholders vote to APPROVE the new Management Agreement. Q. Who is eligible to vote? A. Q. Who is paying for this proxy mailing and for the other expenses and solicitation costs associated with this shareholder meeting? A. Q. What vote is required to approve Proposal 1? A. Trust andvotes cast at the Meeting, either in connection with oneperson or by proxy, is required to approve any adjournment(s) of the Trust’s investmentspecial meeting, even if the number of votes cast is fewer than the number required for a quorum.Q. How can I cast my vote? A. Theof Torray Fund“Fund”“Trust”), I invite you to will hold a special meeting of shareholders (the “Meeting”) of the Torray Fund to be held(the “Fund”) on November 16, 2005, at 11:00 a.m., Eastern Time,December 15, 2021, at the Hyatt Regency Hotel, One Bethesda Metro Center,offices of the Fund’s Manager, Torray LLC, 7501 Wisconsin Avenue, at Old Georgetown Road,Suite 750W, Bethesda, Maryland 20814 (the “Special Meeting”).Atat 9:30 A.M. Eastern Time.Special Meeting as explained more fully in the attached Proxy Statement, you will be askedis to vote onconsider and act upon the following proposal:proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof:Proposal 1.Description1 new InvestmentNew Management Agreement between the Fund and Torray LLC (“Torray”) and the proposed new investment adviserTrust, on behalf of the Torray Fund.2 Fund; andshares represented by the proxies in favor of the adjournment of the Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve Proposal 1.2.To transact such other business as may properly come before the Special Meeting and any adjournments or postponements thereof.The Board of Trustees strongly invites your participation by asking you to review these materials and complete and return your Proxy Card as soon as possible.Detailed information about the proposal is contained in the enclosed materials. In sum, Torray LLC will be a newly formed affiliate of the Fund’s current investment adviser, The Torray Corporation. Torray LLC will be assuming the advisory business of The Torray Corporation and two affiliated entities. The Torray Corporation has two controlling shareholders, Robert E. Torray and Douglas C. Eby. As part of an effort to create a succession plan that insures The Torray Corporation and its affiliated entities remain independent and to facilitate estate planning for Mr. Torray, we intend that ownership interests in Torray LLC will be reallocated among the current owners and that outside investors will acquire a minority ownership interest, resulting in Mr. Eby acquiring majority ownership of Torray LLC. Messrs. Eby and Torray have agreed to enter into long-term employment agreements with Torray LLC.Even though following the contemplated transaction approximately 75% of the Torray LLC ownership interests will continue to be held by the current owners of The Torray Corporation, the intended transfer of majority control to Mr. Eby will constitute an “assignment” of the Fund’s existing Investment Management Agreement with The Torray Corporation, as defined under the Investment Company Act of 1940 (“1940 Act”), which will result in the termination of the Investment Management Agreement according to its terms and the provisions of the 1940 Act. As a result, we are soliciting shareholder proxies to approve a new Investment Management Agreement between the Fund and Torray LLC prior to closing the transaction in accordance with the requirements of the 1940 Act. In soliciting your vote, we want to assure you that there will be no change in our investment approach, our commitment to the future of the business, or the level of effort devoted to the Fund’s portfolio of investments.Your vote is important to us regardless of the number of shares you own. Whether or not you plan to attend the Special Meeting in person, please read the Proxy Statement and cast your vote promptly. It is important that your vote be received no later than the time of the Special Meeting on November 16, 2005.

VOTING IS QUICK AND EASY. EVERYTHING YOU WILL REQUIRE IS ENCLOSED. To cast your vote simply complete, sign and return the Proxy Card in the enclosed postage-paid envelope.

In addition to voting by mail you

| ||

We encourage you to vote by telephoneany adjournments or via the Internet using the control number that appears on your enclosed Proxy Card. Use of telephone or Internet voting will reduce the time and effort associated with this proxy solicitation.

Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

PLEASE TAKE A FEW MINUTES TO READ THE PROXY STATEMENT AND CAST YOUR VOTE. BY VOTING AS SOON AS POSSIBLE YOU SAVE THE FUND THE TROUBLE OF FURTHER SOLICITING YOUR VOTE.

If you have any questions regarding these matters, please do not hesitate to contact us at (800) 443-3036.

|

|

|

|

|

THE TORRAY FUND

(the “Trust”)

7501 Wisconsin Avenue

Suite 1100

Bethesda, Maryland 20814

(800) 443-3036

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 16, 2005

To the Shareholders:

You are entitled to vote at the Special Meeting and any adjournments or postponements thereof if you owned sharesrecord of the Fund at the close of business on September 21, 2005 (the “Record Date”).

Whetherthe record date, October 8, 2021, are entitled to notice of and to vote at the Meeting and any adjournment(s) or not you planpostponements thereof. The Notice of Special Meeting of Shareholders, proxy statement and proxy card are being mailed on or about November 22, 2021, to such shareholders of record.

Secretary of Torray Fund

November 18, 2021

| ||

We encourage you to vote by telephone or via the Internet using the control number that appears on your enclosed Proxy Card. Use of telephone or Internet voting will reduce the time and effort associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

PLEASE RESPOND - WE ASK THAT YOU VOTE PROMPTLY IN ORDER TO AVOID

THE NEED FOR ANY ADDITIONAL SOLICITATION.

| ||||||||

THE TORRAY FUND

(proxy card, date and sign it, and return it in the “Trust”)envelope provided, which needs no postage if mailed in the United States. To avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

Suite 1100

750W

(800) 443-3036

PROXY STATEMENT

December 15, 2021

This proxy statement is being furnishedprovided to you on behalf of the Board of Trustees (the “Board”) of Torray Fund (the “Trust”) in connection with the solicitation of proxies byto be used at the Boardspecial meeting of Trusteesshareholders of the Trust in connection with a matter involving the fund that you are invested in, The Torray Fund (the “Fund”), which is to be voted at a Special Meeting of Shareholders to be held at the Hyatt Regency Hotel, One Bethesda Metro Center, Wisconsin Avenue at Old Georgetown Road, Bethesda, Maryland 20814 on November 16, 2005, at 11:00 a.m., Eastern Time, for theDecember 15, 2021 (the “Meeting”). The purpose set forth below and as described in greater detail in this Proxy Statement. The meeting and any adjournments or postponements of the meetingMeeting is referred(1) to in this Proxy Statement asseek shareholder approval of a new investment management agreement (“New Management Agreement”) between the “Special Meeting.”

You are entitled to vote at the Special Meeting and any adjournments or postponements if you owned sharesTrust, on behalf of the Fund, onand Torray LLC (“Torray”); and (2) to transact such other business as may be properly brought before the close of business on September 21, 2005 (“Record Date”). The date of the first mailing of the Proxy Cards and this Proxy Statement to shareholders will be on or about September 30, 2005.

Only shareholdersSpecial Meeting.

for the Shareholder Meeting to be Held on December 15, 2021:

The Notice of Meeting, Proxy Statement and Proxy Card

are available at https://www.proxy-direct.com/USB-32428

The presence in person or by proxy of the holders of record of 40% of the outstanding shares of the Fund shall constitute a quorum at the Special Meeting, permitting action to be taken.

The Trust will furnish, without charge, afree copy of the Fund’s most recent annual report (andfor the fiscal year ended December 31, 2020, or the most recent semi-annual report, succeeding the annual report) to shareholders upon request, which may be made either by writing toplease contact the Trust at the address above1-800 626-9769 or by calling toll-free (800) 443-3036. The report will be mailed to you by first class mail within three business days of your request.

- 1 -

PROPOSAL

APPROVAL OF A NEW INVESTMENT MANAGEMENT AGREEMENT

What is happening?

The current investment adviserwrite to the Fund, Thec/o Torray Corporation (the “Current Adviser”), has informedLLC, 7501 Wisconsin Avenue, Suite 750W, Bethesda, Maryland 20814

DESCRIPTION OF PROPOSAL 1

APPROVAL OF NEW MANAGEMENT AGREEMENT

Robert E. TorraySale Transactions, and Douglas C. Eby are the two control persons of the Current Adviser based upon their ownership of the common stock of the Current Adviser. Underno other individuals or entities currently own more than a 25% voting interest in Torray. Because the 1940 Act any person who owns beneficially, either directly or through one or more controlled companies, morepresumptively defines the owner of a greater than 25% of the voting securities ofinterest in a company shall be presumed to control such company. As part of the contemplated Transaction, the Current Adviser, the New Adviser, Mr. Torray, Mr. Eby, Mr. William M Lane (an existing shareholder of the Current Adviser) and certain other parties (the “New Investors”) intend to enter into an agreement, pursuant to which Mr. Eby will become the soleas a control person of that company, and presumptively defines the New Adviser and Mr. Torray will remainowner of a significant equity holder, but25% or less voting interest in a company as not a control person of that company, the New Adviser. In addition, it is expected that the New Investors, noneSale Transactions resulted in a change of which is affiliated with the Current Adviser, and Mr. Lane will own the remaining portioncontrol of Torray constituting an assignment of the equity interestsPrior Management Agreement, resulting in the New Adviser, but noneits termination. To ensure continuation of the New Investors or Mr. Lane will hold a controlling interest inadvisory services provided to the New Adviser. Mr. Eby, Mr. Torray and Mr. Lane will hold their interests in the New Adviser indirectly through their ownership of the Current Adviser and two other corporations, Robert E. Torray & Company, Inc. and TEL Corporation, Inc., which are located at 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814. Upon completion of the contemplated Transaction, Mr. Eby will be the controlling equity holder of the New Adviser, Mr. Torray will be the second-largest equity holder of the New Adviser, and it is expected that each of Mr. Torray and Markel Corporation, one of the expected New Investors and a publicly traded international property and casualty insurance holding company, will hold more than 10% of the total equity in the New Adviser. The addresses for each of Mr. Eby, Mr. Torray and Markel Corporation are set forth in “Information About the Current Adviser and the New Adviser” below.

Because Mr. Torray will not be a control person of the New Adviser following the completion of the contemplated Transaction, a change in control would occur for purposes of the 1940 Act. As a result, the Current Agreement will be terminated automatically by operation of law upon the effectiveness of the Transaction, andFund, shareholders of the Fund are hereby being asked to approve a new Investment Management Agreement (the “New Agreement”) between the Fund and the New Adviser, which would take effect followingManagement Agreement.

The terms of the New Agreement are identical to the terms of the Current Agreement, except for the dates of execution, effectiveness, termination and certain other non-material changes. The following pages give you additional information on the contemplated Transaction, the proposed New Agreement for the Fund, and the manner in which the contemplated Transaction will affect you as a shareholder. The approval of the New Agreement for the FundProposal is an important matter to be voted uponapproved by you.

How will the Transaction affect me as a Fund shareholder?

The contemplated Transaction is not expected to result in any changes to the way in which the Fund is managed. The Transaction will not cause any changes to the Fund’s investment objectives or policies. The Transaction will also not affect your shareholdings, and you will continue to own the same number of shares in the Fund as you

- 2 -

do now. The terms of the New Agreement, including the management fee to be paid by the Fund to the New Adviser, are the same in all respects as the Current Agreement, except for the dates of execution, effectiveness, termination and certain other non-material changes. In addition, the Transaction is not expected to result in a change of the investment personnel, including the Fund’s portfolio management team, as Mr. Torray and Mr. Eby will continue to serve as the co-portfolio managersshareholders of the Fund, after the Transaction. After the contemplated Transaction, the New Adviser intends to continue to devote sufficient resources to the management and operation of the Fund. The likely New Investors, including Markel Corporation,Torray will not have an active role in the New Adviser’s day-to-day management and operation of the Fund.

Similarly, the Transaction will not affect the Fund’s contractual relationships with its other service providers, including the Fund’s transfer agent and custodian. Thus, you can expect to continue to receive the same high level of service that you have come to expect as a Fund shareholder.

Will the management fees be the same?

Yes. The investment management fees paid by the Fund will remain the same.

How do the Board members of the Fund recommend that I vote?

After careful consideration, the Fund’s Board of Trustees, including those trustees who are not affiliated with the Trust, the Current Adviser or the New Adviser, recommends that you vote in favor of the Proposal.

Will the Fund pay for the proxy solicitation and legal costs associated with this transaction?

No. The Current Adviser has agreed to bear all of these costs so that the Fund will not have to.

Summary of the Transaction

The Current Adviser was organized as a Maryland corporation in 1990. Currently, its outstanding voting securities are owned by Robert E. Torray, William M Lane and Douglas C. Eby. The New Adviser will acquire all of the assets and liabilities of the Current Adviser in exchange for an equivalent portion of the equity interests in the New Adviser. In addition, it is contemplated that ownership interests in the New Adviser will be reallocated among the current owners and that the New Investors will acquire a minority ownership interest in the New Adviser, resulting in Mr. Eby acquiring majority ownership of the New Adviser. Based upon his majority ownership interest in the New Adviser, Mr. Eby will be deemed to control the New Adviser for purposes of the 1940 Act. Mr. Torray and Mr. Lane will be employees and equity holders of the New Adviser, but they will be deemed not to control the New Adviser under the 1940 Act based on their equity ownership.

Considerations Under the Investment Company Act of 1940

Section 15(a) of the 1940 Act prohibits any person from serving as an investment adviser to a registered investment company except pursuant to a written agreement that has been approved by the shareholders of the investment company. The Current Adviser presently servesserve as the investment manager to the Fund underfor an agreement that was approved byinitial two-year period from the initial shareholdereffective date of the Fund on November 16, 1990 (the “Current Agreement”).New Management Agreement. The Current Agreement was most recently approved by the Board of Trustees at an in-person meeting held on September 28, 2004.

Section 15(a) also provides for the automatic termination of such agreements upon their assignment. An assignment is deemed to include any change of control of Torray is not expected to have any material impact on Torray’s business or operations or the day-to-day portfolio management of the Fund.

| Name | Position/Principal Occupation |

| Shawn M. Hendon | President |

| William M Lane | Executive Vice President |

| Suzanne E. Kellogg | Chief Compliance Officer |

- 3 -

Terms of the Current Agreement and the New Agreement

The terms of the New Agreement are identical to the terms of the Current Agreement, except for the dates of execution, effectiveness, termination and certain other non-material changes. The fees payable by the Fund to the Manager are identicalmanagement agreement that was in the Current and New Agreements.

On August 22 and September 7, 2005, the Board of Trustees met to consider the terms of the proposed Transaction, its effect on the Fund, and the proposed management of the Fund by the New Advisersuch transactions occurred (the “Prior Management Agreement”). As required under the New Agreement. The Trustees, including1940 Act, the Independent Trustees, approved, subject to shareholder approval described herein, the NewPrior Management Agreement between the Fund and the New Adviser. The Trustees recommend approval of the New Agreement by the shareholders of the Fund.

Subject to the control of the Trustees of the Trust, the Current Adviser continuously furnishes an investment programprovided for the Fund and makes investment decisions on behalf of the Fund. The Current Adviser also manages, supervises and conducts the other affairs and business of the Fund, furnishes office space and equipment, provides bookkeeping and certain clerical services and pays all fees and expenses of the officers of the Fund.

Duties Under the New Agreement. Upon the completion of the proposed Transaction, and assuming shareholder approval of the New Agreement, the New Adviser will continue to provide these same services as are presently being provided to the Fund by the Current Adviser. Under the New Agreement, the New Adviser will: (i) furnish continuously an investment program for the Fund and will make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities, and (ii) manage, supervise and conduct the other affairs and business of the Fund, furnish office space and equipment, provide bookkeeping and clerical services, and pay all salaries, fees and expenses of the officers and Trustees of the Trust who are affiliated with the New Adviser. The New Adviser will discharge its responsibilities subject to the control of the Trustees and in a manner consistent with the Fund’s investment objectives, policies and limitations.

Duration and Termination. Upon the completion of the proposed Transaction, and assuming shareholder approval of the New Agreement, and unless terminated earlier, the New Agreement shall continue in effect as to the Fund through November 1, 2006 and thereafter for periods of one year for so long as such continuance is specifically approved at least annually: (i) by the vote of the holders of a majority of the outstanding shares of the Fund or (ii) by the vote of a majority of the Independent Trustees of the Trust, cast in person at a meeting called for the purpose of voting on such approval.

The New Agreement will terminate automaticallyautomatic termination in the event of its assignment. The NewAccordingly, the Prior Management Agreement is terminable at any time without penalty by: (i) byterminated upon the Trusteesconsummation of the Trust; (ii) by a vote of a majority ofSale Transactions.

Compensation. Like the Current Agreement, under the New Agreement the New Adviser will receive a fee computed daily and paid monthly at the annual rate of 1.00% of the average daily net asset value of the Fund.

Limitations on Liability. Like the Current Agreement, the New Agreement provides that the New Adviser will not be liable for any act or omission in the course of, or connected with, rendering services under the agreement, but will be liable only for willful misfeasance, bad faith or gross negligence or reckless disregard of its obligations under the agreement.

Information About the Current Adviser and the New Adviser

The Current Adviser is located at 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814. The Current Adviser is owned by Mr. Torray, Mr. Eby and Mr. Lane. Robert E. Torray has served as President of the Current Adviser since it was organized in 1990. Mr. Torray is also the Chairman of Robert E. Torray & Co., Inc., a manager of large institutional portfolios that he founded on May 1, 1972, and the Chairman of TEL Corporation, Inc., a private investment fund manager that was founded on October 14, 2003, both of which are collectively owned by Mr. Torray, Mr. Eby and Mr. Lane. Douglas C. Eby, the Fund’s co-manager, joined the Current

- 4 -

Adviser in 1992. He serves as the Executive Vice President and is also President of Robert E. Torray & Co., Inc. and TEL Corporation. Mr. Torray is 68 and Mr. Eby is 46. As co-portfolio managers, Mr. Torray and Mr. Eby share equally in the day-to-day management of the Fund’s investment portfolio.

The Current Adviser provides investment advice and portfolio management services and oversees the administration of the Fund pursuant to the terms of the Current Agreement. The Current Agreement is dated as of November 16, 1990 and was last approved by shareholders of the Fund on November 16, 1990 whendo not approve the New Management Agreement, the Board will take action as it was submitted todeems necessary in the votebest interests of the then sole shareholder of the Fund in connection with the establishment and organizationshareholders of the Fund. The Current Adviser received 1.00%At its September 22, 2021 Board meeting, the Board discussed the course of action it might take in the Fund’s average daily net assets as compensation for these services forunlikely scenario that the fiscal year ended December 31, 2004, which amountedNew Management Agreement is not approved within 150 daysof the change in control transactions that were consummated on September 30, 2021. Both the Board and the Registrant are fully aware that if the New Management Agreement is not approved by February 27, 2022, there will not be an advisory agreement in place that would permit Torray to $16,893,454. The Current Adviser also provides investment advice to The Torray Institutional Fund, which is another fund having similar investment objectives as the Fund. The Torray Institutional Fund requires a minimum investment of $5 million and is primarily intended as an investment vehicle for institutional accounts. The Current Adviser is entitled to receive a comprehensive management fee from The Torray Institutional Fund which covers all of the operating expenses of that fund, including investment advisory and management services, at a rate equal to 0.85% of that fund’s average daily net assets. As of August 31, 2005, The Torray Institutional Fund had total assets of approximately $1.3 billion.

The Current Adviser is registered as an investment adviser with the Securities and Exchange Commission and as of August 31, 2005 had approximately $6.4 billion in assets under management.

The New Adviser will assume the day-to-day management and operations responsibility for the Fund. The New Adviser will continue to operate out of the offices presently occupied by the Current Adviser. Mr. Torray and Mr. Eby will be officers and employees of the New Adviser, as well as the New Adviser’s two largest equity holders, and they will continue to serve as the co-portfolio managers of the Fund in their capacities with the New Adviser.

Mr. Eby and Mr. Torray are each located at 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814. Markel Corporation is located at 4521 Highwoods Parkway, Glen Allen, Virginia 23060.

Shareholder Approval

The Proposal requires the affirmative vote of a “majority of the outstanding shares” of the Fund. The term “majority of outstanding shares,” as defined in the 1940 Act and as used in this Proxy Statement with respectprovide advisory serves to the Fund means:after that date. To address these concerns, the affirmativeRegistrant, with the Board’s approval, will take the following measures. As a first step, if the requisite approval is not obtained at the December 15, 2021 Shareholder Meeting, the Registrant will seek to adjourn the Shareholder Meeting by the requisite vote of the lesser of (1) 67% of the voting securities of the Fundshareholders present at the Special Meeting if more than 50% of the outstanding shares of the Fund are present in person or by proxy until a later date or (2) more than 50%dates, and continue to solicit the necessary votes for passage of the outstanding shares of the Fund.

Factors Considered by the Trustees and their Recommendation

At their meetings on August 22 and September 7, 2005, the Trustees discussed and consideredProposal. If shareholders have not approved the New Management Agreement by January 15, 2022, the Registrant will advise Commission staff of that fact and apprise the staff whether it intends to seek no-action relief, in light ofa manner that is consistent with no-action relief that the proposed Transaction. Among other things,staff has granted in similar circumstances, to allow the Trustees considered representations from the Current Adviser that it is anticipating no material changesRegistrant to the management and operation ofcontinue to provide advisory services to the Fund after the Transaction and that the personnel currently responsible for the investment managementexpiration of the Fund are intended150-day term of the Interim Management Agreement while also continuing to continue serving in their respective roles. In connection with this, the Trustees placed particular emphasissolicit votes on the factproposal to approve the New Management Agreement. In that Mr. Torrayregard, Registrant represents that its counsel has reviewed and Mr. Eby will continue to serveis familiar with the staff’s October 2013 Guidance on these matters and the no-action letter cited therein,1 as well as the co-portfolio managersStaff’s 2017 no-action relief in Nuveen Fund Advisors, LLC,2 and would intend to seek relief consistent with the representations and conditions of the Fund as employees ofsuch authority. Registrant acknowledges that there is no guarantee such relief will be granted. If sufficient shareholder votes to approve the New Adviser and, in addition, that Mr. Torray and Mr. Eby will enter into long-term employment agreements with the New Adviser. The Trustees also considered representations from the Current Adviser that motivating factors for the Transaction are an effort to create a succession plan that ensures the Current Adviser and its affiliated entities remain independent and the estate planning objectives of Mr. Torray. The Trustees also considered that the material terms and conditions and the fees payable under the CurrentManagement Agreement are not scheduled to be changed underobtained during the New Agreement.

- 5 -

Amongperiod of no-action relief, or if the factorsstaff does not issue the requested relief, the Fund’s Board considered waswill consider and determine what further actions it might take in the overall performancebest interests of Fund shareholders, including potentially merging the Fund achieved bywith another mutual fund or liquidating and deregistering the Current Adviser relative toFund.

In addition, the Board reviewed with the Current Adviser information regarding its brokerage practices, including soft dollar matters, which the Current Adviser does not have any agreements to do, and its best execution procedures, which the Board noted were reasonable and consistent with standard industry practice, and the Board was informed by the New Adviser that it intends to continue to follow these same brokerage practices.

Based on this review, and in light of the terms of the contemplated Transaction, the Trustees concluded that the management services contemplated under the New Agreement are reasonably worth the full amount of the fee, plus any benefits that incidentally may accrue to the New Adviser, and that the terms of the New Agreement are fair and reasonable. Accordingly, the Trustees, including a majority of the Independent Trustees, approved the New Agreement and voted to recommend its approval by the shareholders of the Fund.

The Board was alsobeen advised that the Current Adviser intendsSale Transactions would be structured to rely oncomply with the safe harbor provisions of Section 15(f) of the 1940 Act whichin that Torray has agreed that, following the closing of the Sale Transactions, it will use reasonable best efforts to enable the requirement of Section 15(f) to be met. Section 15(f) provides a non-exclusive safe harbor forwhereby an owner of an investment adviser to an investment company or any of(such as the investment adviser’s affiliated persons (as defined under the 1940 Act) toFund) may receive any amountpayment or benefit in connection with athe sale of securities ofan interest in the investment adviser that results in a change in control of the investment adviser so long asif two conditions are met. First, for asatisfied.

- 6 -

Management Agreement for the Fund on the basis that its terms and conditions are fair and reasonable and in the best interests of the Fund and its shareholders.

DESCRIPTION OF PROPOSAL 2

AUTHORIZATION OF PROXIES TO VOTE THE TRUSTEES RECOMMEND THAT THE SHAREHOLDERSSHARES IN FAVOR OF THE FUND

VOTEFOR APPROVALADJOURNMENT OF THE NEW AGREEMENT.

GENERAL INFORMATION ABOUT THE TRUST

Distributor

MEETING

Custodian and Transfer Agent

PFPC Trust Company, 400 Bellevue Parkway, Wilmington, DE 19809, is the custodianFund’s governing documents. Any adjournment of the Meeting for the Fund. PFPC Inc., 760 Moore Road, Kingpurpose of Prussia, PA 19406 serves as transfer agent and shareholder servicing agentsoliciting additional proxies will allow the Fund’s shareholders who have already sent in their proxies to the Fund.

OTHER BUSINESS

Other Matters to Come Before the Special Meeting

The Board does not intend to presentrevoke them at any other businesstime before their use at the Special Meeting. If, however,Meeting, as adjourned.

Proposals of Shareholders

The Trust does not hold annual shareholder meetings. Any shareholder proposal intended to be presented at any future meeting of shareholders must be received by the Trust at its principal office a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in that Proxy Statement relating to such meeting.

Shareholders who wish to communicate with the Board should send communications to the attention of the Secretary of the Trust, 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814 and communications will be directed to the Trustee or Trustees indicated in the communication or, if no Trustee or Trustees are indicated, to the Chairman of the Board.

VOTING

This Proxy Statement is furnished in connection with a solicitation of proxies by the Board to be used at the Special Meeting. This Proxy Statement, along with a Notice of the Special Meeting and Proxy Card, is first being mailed to shareholders of the Fund on or about September 30, 2005. ABOUT OWNERSHIP OF SHARES OF THE FUND

Shareholder | # of Shares | % of Fund |

JP Morgan Securities LLC Brooklyn, NY 11201-3873 | 1,093,471 | 16% |

Charles Schwab & Co. Inc. FBO Schwab Customers San Francisco, CA 94105-1905 | 498,530 | 7% |

National Financial Services LLC Jersey City, NJ 07310-1995 | 402,469 | 6% |

Quorum and Voting Requirement

The presence at any shareholders meeting,Meeting, in person or by proxy, of the holders of 40%shareholders representing forty percent of the Fund’s shares outstanding sharesand entitled to be cast shall be necessary and sufficient to constitutevote as of the Record Date constitutes a quorum for the transaction of business.

- 7 -

TheSpecial Meeting. It is the Fund’s understanding that because Proposal requires the affirmative vote of a “majority of the outstanding shares” of the Fund. The term “majority of outstanding shares,” as defined by the Investment Company Act of 1940, as amended (the “1940 Act”) and as used in this Proxy Statement with respect to the Fund, means: the affirmative vote of the lesser of (1) 67% of the voting securities of the Fund present1 presented for approval at the Special Meeting if more than 50%is a “non-routine” matter, broker-dealers and other intermediaries will not have discretionary authority to vote on that proposal in the absence of specific authorization from their customers. In the outstanding sharesabsence of the Fund aresuch specific authorization, such broker-dealers and intermediaries also will not be counted as present in person or by proxy or (2) more than 50%for purposes of the outstanding shares of the Fund.

ADJOURNMENTS

establishing a quorum. In the event that sufficient votesthe necessary quorum to transact business or the vote required to approve Proposal 1 is not obtained at the proposals are not received,Special Meeting, the persons named as proxies may propose one or more adjournments of the Special Meeting with respect to the Proposal in accordance with applicable law to permit further solicitation of proxies. Any such adjournment of the Special Meeting will require anthe affirmative vote byof the holders of a simple majority of the Fund’s shares cast at the Special Meeting, even if the number of votes cast is fewer than the number required for a quorum, and any adjournment with respect to the Proposals will require the affirmative vote of the Trust present in person or by proxy andholders of a simple majority of the Fund’s shares entitled to vote on the Proposal cast at the Special Meeting. The persons named as proxies will vote for or against any adjournment in favortheir discretion.

EFFECT OF ABSTENTIONS AND BROKER NON-VOTES

For purposes of determining the presencevote of a quorum for transacting businessmajority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the shares of the Fund present at a shareholder meeting if the Special Meeting, abstentions and broker “non-votes” (that is, proxies from brokers or nominees indicating that such persons have not received instructions fromowners of more than 50% of the beneficial owner or other persons entitled to vote shares on a particular matter with respect to whichof the brokers or nominees do not have discretionary power) will be treated as Shares thatFund then outstanding are present but which have not been voted.

Abstentions will have the effect of a “no” vote. Broker non-votes will have the effect of a “no” vote for the Proposal where a vote is determined on the basis of obtaining the affirmative vote ofin person or by proxy, or (b) more than 50% of the outstanding shares of the Fund identifiedentitled to vote at the meeting. Abstentions and broker “non-votes”, if any, will have the effect of a “no” vote for purposes of obtaining the requisite approval of the proposal.

Broker-dealer firms holding sharesMeeting may withdraw a previously submitted proxy and vote in person. To obtain directions on how to attend the Special Meeting and vote in person, please call 1- 888-456-7566.

If you hold shares of the Fund through a bank or other financial institution or intermediary (called a service agent) that has entered into a service agreement with the Fund or an affiliate or agent of the Fund, the service agent may be the record holder of your shares. At the Special Meeting, a service agent will vote shares for which it receives instructions from its customers in accordance with those instructions. A signed proxy card or other authorization bytheir instructions, and to confirm that a shareholder that does not specify how the shareholder’s shares should be voted on the Proposal may be deemed to vote such shares in favor of the Proposal. If a service agent is not a member of the NYSE, it may be permissible for the service agent to vote shares with respect to which it has not received specific voting instructions from its customers on the Proposal.

- 8 -

PROXY SOLICITATION

Proxies are being solicited by mail. Additional solicitations may be made by telephone, fax, e-mail, or by personal contact by officers or employees of the Current Adviser and its affiliates. have been properly recorded.

SHARE INFORMATION

Holderssolicitation by mail, officers and employees of recordTorray, who will receive no extra compensation for their services, may solicit proxies by telephone, e-mail or other electronic means, letter or facsimile.

and its shareholders.

As of the Record Date the following entities owned beneficially or of record 5% or more of the Fund’s shares.

| ||

| ||

9

Appendix

MANAGEMENT CONTRACT

Management Contract executed as of

Witnesseth:

A-1

under common control with the Manager may have an interest in the Trust. It is also understood that the Manager and persons controlled by or under common control with the Manager have and may have advisory, management service, distribution or other contracts with other organizations and persons, and may have other interests and businesses.

3. COMPENSATION TO BE PAID BY THE FUND TO THE MANAGER.

The Fund will pay to the Manager as compensation for the Manager’s

If the Manager shall serve for less than the whole of a month, the foregoing compensation shall be prorated.

4.ASSIGNMENT TERMINATES THIS CONTRACT; AMENDMENTS OF THIS CONTRACT.

(b) If (i) the Trustees of the Trust or the shareholders of the affirmative vote of a majority of the outstanding shares of the Trust, and (ii) a majority of the Trustees of the Trust who are not interested persons of the Trust or of the Manager, by vote cast in person at a meeting called for the purpose of voting on such approval, do not specifically approve – at least annually the continuance of this Contract, then this Contract shall automatically terminate at the close of business on the second anniversary of its execution, or upon the expiration of one year from the effective date of the last such continuance, whichever is later; provided, however, that if the continuance of this Contract is submitted to the shareholders of the Trust for their approval and such shareholders fail to approve such continuance of this Contract as provided herein, the Manager may continue to serve hereunder in a manner consistent with the 1940 Act and the rules and regulations thereunder.

Action by the Trust under (a) above may be taken either (i) by vote of a majority of its Trustees, or (ii) by the affirmative vote of a majority of the outstanding shares of the Trust.

Termination of this Contract pursuant to this Section 5 shall be without the payment of any penalty.

For the purposes of this Contract, the “affirmative vote of a majority of the outstanding shares” means the affirmative vote, at a duly called and held meeting of shareholders, (a) of the holders of 67% or more of the shares of the Fund present (in person or by proxy) and entitled to vote at such meeting, if the holders of more than 50% of the outstanding shares of the Fund entitled to vote at such meeting are present in person or by proxy, or (b) of the holders of more than 50% of the outstanding shares of the Fund entitled to vote at such meeting, whichever is less.

A-2

For the purposes of this Contract, the terms “affiliated person, ““control,” “interested person” and “assignment” shall have their respective meanings defined in the 1940 Act and the rules and regulations thereunder, subject, however to such exemptions as may be granted by the Securities and Exchange Commission under said Act; the term “specifically approve at least annually” shall be construed in a manner consistent with the 1940 Act and the rules and regulations thereunder; and the term “brokerage and research services” shall have the meaning given in the Securities Exchange Act of 1934 and the rules and regulations thereunder.

The word “Torray” to be used in the Fund’s name belongs exclusively to the Manager, and may be used by the Fund only so long as this Contract has not been terminated.

In the absence of willful misfeasance, bad faith or gross negligence on the part of the Manager, or reckless disregard of its obligations and duties hereunder, the Manager shall not be subject to any liability to the Fund, or to any shareholder of the Fund, for any act or omission in the course of, or connected with, rendering services hereunder.

A copy of the Agreement and Declaration of Trust of the Trust is on file with the Secretary of The Commonwealth of Massachusetts, and notice is hereby given that this instrument is executed on behalf of the Trustees of the Trust as Trustees and not individually and that the obligations of this instrument are not binding upon any of the Trustees or shareholders individually but are binding only upon the assets and property of the Trust.

IN WITNESS WHEREOF, THE TORRAY FUND, on behalf of its investment series THE TORRAY FUND, and THE TORRAY COMPANY, LLC have each caused this instrument to be signed on its behalf by its duly authorized representative, all as of the day and year first above written.

| ||

A-3

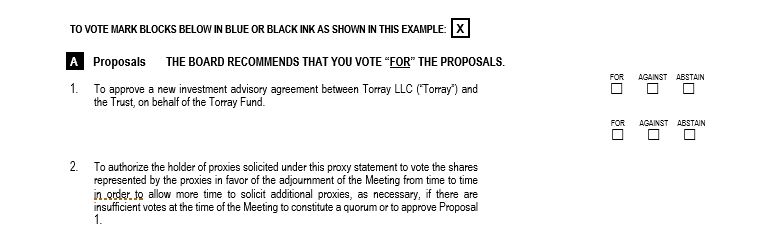

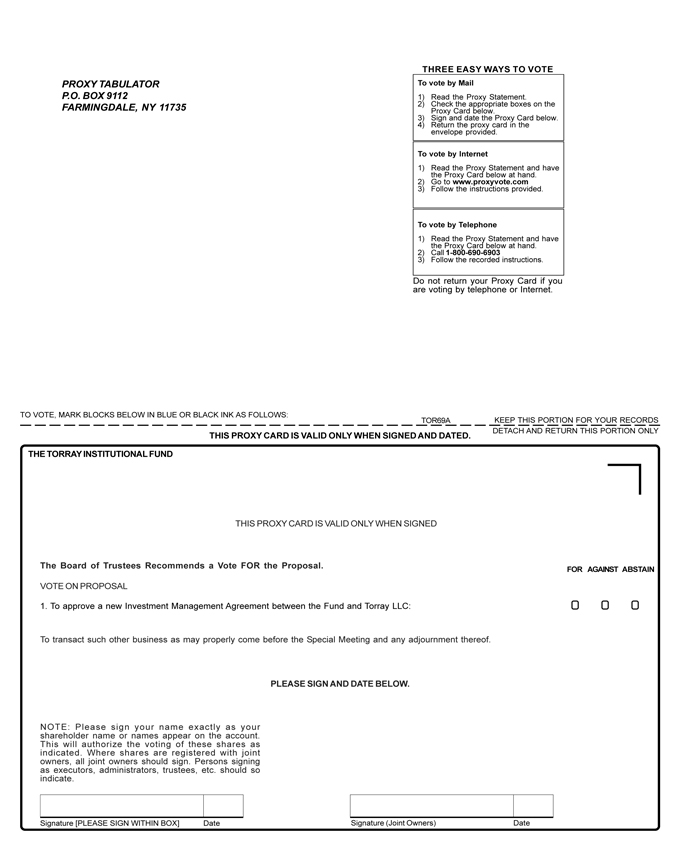

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

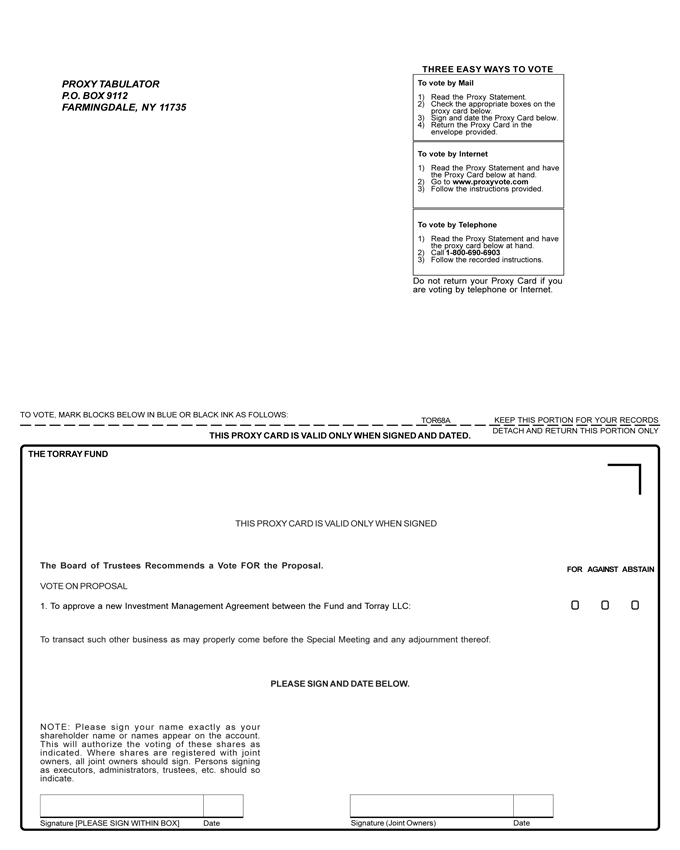

PROXY TABULATOR P.O. BOX 9112 FARMINGDALE, NY 11735

THREE EASY WAYS TO VOTE

To vote by Mail

1) Read the Proxy Statement.

2) Check the appropriate boxes on the proxy card below.

3) Sign and date the Proxy Card below.

4) Return the Proxy Card in the envelope provided.

To vote by Internet

1) Read the Proxy Statement and have the Proxy Card below at hand.

2) Go to www.proxyvote.com

3) Follow the instructions provided.

To vote by Telephone

1) Read the Proxy Statement and have the proxy card below at hand.

2) Call 1-800-690-6903

3) Follow the recorded instructions.

Do not return your Proxy Card if you are voting by telephone or Internet.

TOR68A

KEEP THIS PORTION FOR YOUR RECORDS

DETACH AND RETURN THIS PORTION ONLY

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

THE TORRAY FUND

THIS PROXY CARD IS VALID ONLY WHEN SIGNED

The Board of Trustees Recommends a Vote FOR the Proposal.

VOTE ON PROPOSAL

1. To approve a new Investment Management Agreement between the Fund and Torray LLC:

To transact such other business as may properly come before the Special Meeting and any adjournment thereof.

FOR AGAINST ABSTAIN

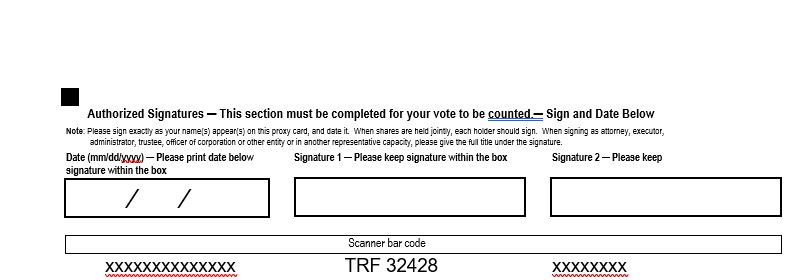

PLEASE SIGN AND DATE BELOW.

NOTE: Please sign your name exactly as your shareholder name or names appear on the account. This will authorize the voting of these shares as indicated. Where shares are registered with joint owners, all joint owners should sign. Persons signing as executors, administrators, trustees, etc. should so indicate.

Signature [PLEASE SIGN WITHIN BOX] Date

Signature (Joint Owners) Date

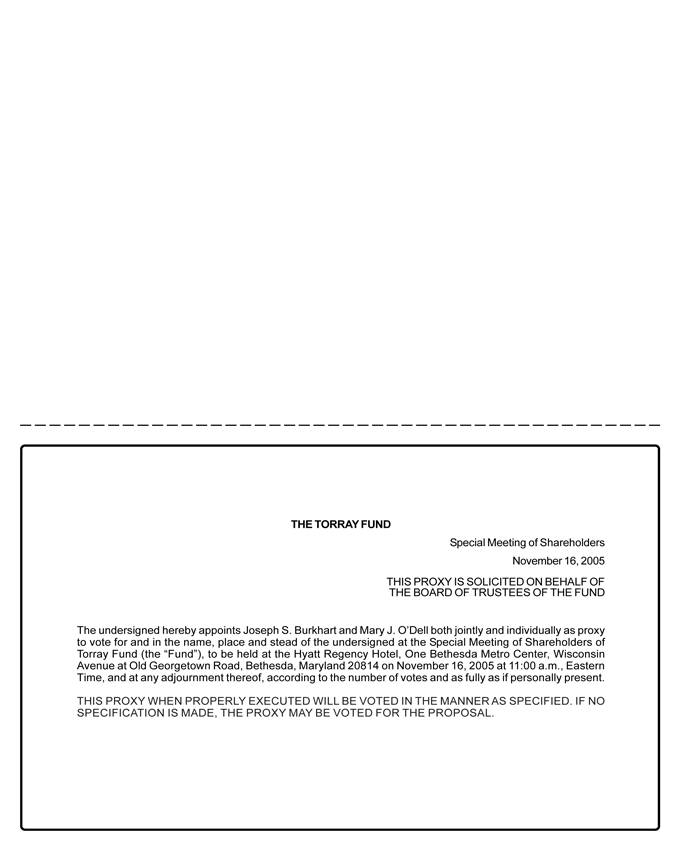

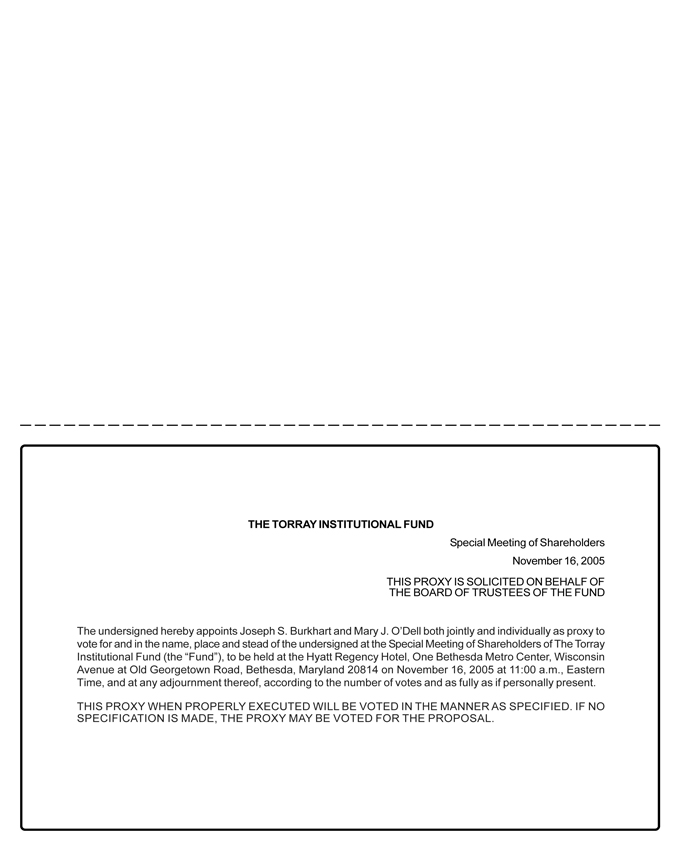

THE TORRAY FUND

Special Meeting of Shareholders November 16, 2005 THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF TRUSTEES OF THE FUND

The undersigned hereby appoints Joseph S. Burkhart and Mary J. O’Dell both jointly and individually as proxy to vote for and in the name, place and stead of the undersigned at the Special Meeting of Shareholders of Torray Fund (the “Fund”), to be held at the Hyatt Regency Hotel, One Bethesda Metro Center, Wisconsin Avenue at Old Georgetown Road, Bethesda, Maryland 20814 on November 16, 2005 at 11:00 a.m., Eastern Time, and at any adjournment thereof, according to the number of votes and as fully as if personally present.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER AS SPECIFIED. IF NO SPECIFICATION IS MADE, THE PROXY MAY BE VOTED FOR THE PROPOSAL.

THE TORRAY FUND(b)

(the “Trust”)

7501 Wisconsin Avenue

Suite 1100

Bethesda, Maryland 20814

(800) 443-3036

September 30, 2005

Dear Shareholder:

On behalf of the Board of Trustees of the Trust and in connection with one of the Trust’s investment series, The Torray Institutional Fund (the “Fund”), I invite you to a special meeting of shareholders of the Fund to be held on November 16, 2005, at 11:00 a.m., Eastern Time, at the Hyatt Regency Hotel, One Bethesda Metro Center, Wisconsin Avenue at Old Georgetown Road, Bethesda, Maryland 20814 (the “Special Meeting”).

At the Special Meeting, as explained more fully in the attached Proxy Statement, you will be asked to vote on the following proposal:

The Board of Trustees strongly invites your participation by asking you to review these materials and complete and return your Proxy Card as soon as possible.

Detailed information about the proposal is contained in the enclosed materials. In sum, Torray LLC will be a newly formed affiliate of the Fund’s current investment adviser, The Torray Corporation. Torray LLC will be assuming the advisory business of The Torray Corporation and two affiliated entities. The Torray Corporation has two controlling shareholders, Robert E. Torray and Douglas C. Eby. As part of an effort to create a succession plan that insures The Torray Corporation and its affiliated entities remain independent and to facilitate estate planning for Mr. Torray, we intend that ownership interests in Torray LLC will be reallocated among the current owners and that outside investors will acquire a minority ownership interest, resulting in Mr. Eby acquiring majority ownership of Torray LLC. Messrs. Eby and Torray have agreed to enter into long-term employment agreements with Torray LLC.

Even though following the contemplated transaction approximately 75% of the Torray LLC ownership interests will continue to be held by the current owners of The Torray Corporation, the intended transfer of majority control to Mr. Eby will constitute an “assignment” of the Fund’s existing Investment Management Agreement with The Torray Corporation, as defined under the Investment Company Act of 1940 (“1940 Act”), which will result in the termination of the Investment Management Agreement according to its terms and the provisions of the 1940 Act. As a result, we are soliciting shareholder proxies to approve a new Investment Management Agreement between the Fund and Torray LLC prior to closing the transaction in accordance with the requirements of the 1940 Act. In soliciting your vote, we want to assure you that there will be no change in our investment approach, our commitment to the future of the business, or the level of effort devoted to the Fund’s portfolio of investments.

Your vote is important to us regardless of the number of shares you own. Whether or not you plan to attend the Special Meeting in person, please read the Proxy Statement and cast your vote promptly. It is important that your vote be received no later than the time of the Special Meeting on November 16, 2005.

VOTING IS QUICK AND EASY. EVERYTHING YOU WILL REQUIRE IS ENCLOSED. To cast your vote simply complete, sign and return the Proxy Card in the enclosed postage-paid envelope.

In addition to voting by mail you may also vote by either telephone or via the Internet, as follows:

| ||

We encourage you to vote by telephone or via the Internet using the control number that appears on your enclosed Proxy Card. Use of telephone or Internet voting will reduce the time and effort associated with this proxy solicitation.

Whichever method you choose, please read the enclosed proxy statement carefully before you vote.

PLEASE TAKE A FEW MINUTES TO READ THE PROXY STATEMENT AND

CAST YOUR VOTE. BY VOTING AS SOON AS POSSIBLE YOU SAVE THE

FUND THE TROUBLE OF FURTHER SOLICITING YOUR VOTE.

If you have any questions regarding these matters, please do not hesitate to contact us at (800) 443-3036.

|

|

|

|

|

THE TORRAY FUND

(the “Trust”)

7501 Wisconsin Avenue

Suite 1100

Bethesda, Maryland 20814

(800) 443-3036

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 16, 2005

To the Shareholders:

The Board of Trustees of the Trust has scheduled a special meeting of shareholders of The Torray Institutional Fund (the “Fund”) (the “Special Meeting”) to be held on November 16, 2005, at 11:00 a.m., Eastern Time at the Hyatt Regency Hotel, One Bethesda Metro Center, Wisconsin Avenue at Old Georgetown Road, Bethesda, Maryland 20814, for the following purpose:

To approve a new Investment Management Agreement between the Fund and Torray LLC, the proposed new investment adviser to the Fund; and

To transact such other business as may properly come before the Special Meeting and any adjournments or postponements thereof.

You are entitled to vote at the Special Meeting and any adjournments or postponements thereof if you owned shares of the Fund at the close of business on September 21, 2005 (the “Record Date”).

Whether or not you plan to attend the Special Meeting in person, please vote your shares. In addition to voting by mail you may also vote by telephone or via the Internet, as follows:

| ||

We encourage you to vote by telephone or via the Internet using the control number that appears on your enclosed Proxy Card. Use of telephone or Internet voting will reduce the time and effort associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

PLEASE RESPOND - WE ASK THAT YOU VOTE PROMPTLY IN ORDER TO AVOID

THE NEED FOR ANY ADDITIONAL SOLICITATION.

| ||||

| ||||

| ||||

| ||||

| ||||

|

| |||

THE TORRAY FUND

(the “Trust”)

7501 Wisconsin Avenue

Suite 1100

Bethesda, Maryland 20814

(800) 443-3036

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 16, 2005

This proxy statement is being furnished to you in connection with the solicitation of proxies by the Board of Trustees of the Trust in connection with a matter involving the fund that you are invested in, The Torray Institutional Fund (the “Fund”), which is to be voted at a Special Meeting of Shareholders to be held at the Hyatt Regency Hotel, One Bethesda Metro Center, Wisconsin Avenue at Old Georgetown Road, Bethesda, Maryland 20814, on November 16, 2005, at 11:00 a.m., Eastern Time, for the purpose set forth below and as described in greater detail in this Proxy Statement. The meeting and any adjournments or postponements of the meeting is referred to in this Proxy Statement as the “Special Meeting.”

You are entitled to vote at the Special Meeting and any adjournments or postponements if you owned shares of the Fund on the close of business on September 21, 2005 (“Record Date”). The date of the first mailing of the Proxy Cards and this Proxy Statement to shareholders will be on or about September 30, 2005.

Only shareholders of record at the close of business on the Record Date will be entitled to notice of, and to vote at, the Special Meeting. Shares represented by proxies, unless previously revoked, will be voted at the Special Meeting in accordance with the instructions of the shareholders. If Proxy Cards have been executed, but no instructions are given, such proxies will be voted in favor of the proposal. To revoke a proxy, the shareholder giving such proxy must either (1) submit to the Fund a subsequently dated Proxy Card, (2) deliver to the Fund a written notice of revocation at the address stated above, or (3) otherwise give notice of revocation in open meeting, in all cases prior to the exercise of the authority granted in the proxy.

The presence in person or by proxy of the holders of record of 40% of the outstanding shares of the Fund shall constitute a quorum at the Special Meeting, permitting action to be taken.

The Trust will furnish, without charge, a copy of the Fund’s most recent annual report (and the most recent semi-annual report succeeding the annual report) to shareholders upon request, which may be made either by writing to the Trust at the address above or by calling toll-free (800) 443-3036. The report will be mailed to you by first class mail within three business days of your request.

- 1 -

PROPOSAL

APPROVAL OF A NEW INVESTMENT MANAGEMENT AGREEMENT

What is happening?

The current investment adviser to the Fund, The Torray Corporation (the “Current Adviser”), has informed the Board of Trustees that it will transfer all of its assets and liabilities to a soon-to-be formed investment advisory firm, Torray LLC (the “New Adviser”), in exchange for an equivalent portion of the equity interests in the New Adviser, which transaction is permissible under the terms of the existing Investment Management Agreement between the Fund and the Current Adviser (the “Current Agreement”) and the applicable provisions of the Investment Company Act of 1940 (the “1940 Act”). In addition, the New Adviser intends to enter into an agreement to consummate a transaction (the “Transaction”) that will result in a change in control for purposes of the 1940 Act. Upon the change in control, the Current Agreement will terminate in accordance with its terms and the terms of the applicable provisions of the 1940 Act.

Robert E. Torray and Douglas C. Eby are the two control persons of the Current Adviser based upon their ownership of the common stock of the Current Adviser. Under the 1940 Act, any person who owns beneficially, either directly or through one or more controlled companies, more than 25% of the voting securities of a company shall be presumed to control such company. As part of the contemplated Transaction, the Current Adviser, the New Adviser, Mr. Torray, Mr. Eby, Mr. William M Lane (an existing shareholder of the Current Adviser) and certain other parties (the “New Investors”) intend to enter into an agreement, pursuant to which Mr. Eby will become the sole control person of the New Adviser and Mr. Torray will remain a significant equity holder, but not a control person, of the New Adviser. In addition, it is expected that the New Investors, none of which is affiliated with the Current Adviser, and Mr. Lane will own the remaining portion of the equity interests in the New Adviser, but none of the New Investors or Mr. Lane will hold a controlling interest in the New Adviser. Mr. Eby, Mr. Torray and Mr. Lane will hold their interests in the New Adviser indirectly through their ownership of the Current Adviser and two other corporations, Robert E. Torray & Company, Inc. and TEL Corporation, Inc., which are located at 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814. Upon completion of the contemplated Transaction, Mr. Eby will be the controlling equity holder of the New Adviser, Mr. Torray will be the second-largest equity holder of the New Adviser, and it is expected that each of Mr. Torray and Markel Corporation, one of the expected New Investors and a publicly traded international property and casualty insurance holding company, will hold more than 10% of the total equity in the New Adviser. The addresses for each of Mr. Eby, Mr. Torray and Markel Corporation are set forth in “Information About the Current Adviser and the New Adviser” below.

Because Mr. Torray will not be a control person of the New Adviser following the completion of the contemplated Transaction, a change in control would occur for purposes of the 1940 Act. As a result, the Current Agreement will be terminated automatically by operation of law upon the effectiveness of the Transaction, and shareholders of the Fund are hereby being asked to approve a new Investment Management Agreement (the “New Agreement”) between the Fund and the New Adviser, which would take effect following the completion of the contemplated Transaction. In addition to the signing of definitive documentation, the receipt of the requisite shareholder vote in favor of the New Agreement will be a condition to the closing of the Transaction.

The terms of the New Agreement are identical to the terms of the Current Agreement, except for the dates of execution, effectiveness, termination and certain other non-material changes. The following pages give you additional information on the contemplated Transaction, the proposed New Agreement for the Fund, and the manner in which the contemplated Transaction will affect you as a shareholder. The approval of the New Agreement for the Fund is an important matter to be voted upon by you.

How will the Transaction affect me as a Fund shareholder?

The contemplated Transaction is not expected to result in any changes to the way in which the Fund is managed. The Transaction will not cause any changes to the Fund’s investment objectives or policies. The Transaction will also not affect your shareholdings, and you will continue to own the same number of shares in the Fund as you

- 2 -

do now. The terms of the New Agreement, including the management fee to be paid by the Fund to the New Adviser, are the same in all respects as the Current Agreement, except for the dates of execution, effectiveness, termination and certain other non-material changes. In addition, the Transaction is not expected to result in a change of the investment personnel, including the Fund’s portfolio management team, as Mr. Torray and Mr. Eby will continue to serve as the co-portfolio managers of the Fund after the Transaction. After the Transaction, the New Adviser intends to continue to devote sufficient resources to the management and operation of the Fund. The likely New Investors, including Markel Corporation, will not have an active role in the New Adviser’s day-to-day management and operation of the Fund.

Similarly, the Transaction will not affect the Fund’s contractual relationships with its other service providers, including the Fund’s transfer agent and custodian. Thus, you can expect to continue to receive the same high level of service that you have come to expect as a Fund shareholder.

Will the management fees be the same?

Yes. The investment management fees paid by the Fund will remain the same.

How do the Board members of the Fund recommend that I vote?

After careful consideration, the Fund’s Board of Trustees, including those trustees who are not affiliated with the Trust, the Current Adviser or the New Adviser, recommends that you vote in favor of the Proposal.

Will the Fund pay for the proxy solicitation and legal costs associated with this transaction?

No. The Current Adviser has agreed to bear all of these costs so that the Fund will not have to.

Summary of the Transaction

The Current Adviser was organized as a Maryland corporation in 1990. Currently, its outstanding voting securities are owned by Robert E. Torray, William M Lane and Douglas C. Eby. The New Adviser will acquire all of the assets and liabilities of the Current Adviser in exchange for an equivalent portion of the equity interests in the New Adviser. In addition, it is contemplated that ownership interests in the New Adviser will be reallocated among the current owners and that the New Investors will acquire a minority ownership interest in the New Adviser, resulting in Mr. Eby acquiring majority ownership of the New Adviser. Based upon his majority ownership interest in the New Adviser, Mr. Eby will be deemed to control the New Adviser for purposes of the 1940 Act. Mr. Torray and Mr. Lane will be employees and equity holders of the New Adviser, but they will be deemed not to control the New Adviser under the 1940 Act based on their equity ownership.

Considerations Under the Investment Company Act of 1940

Section 15(a) of the 1940 Act prohibits any person from serving as an investment adviser to a registered investment company except pursuant to a written agreement that has been approved by the shareholders of the investment company. The Current Adviser presently serves as the investment manager to the Fund under an agreement that was approved by the initial shareholder of the Fund on June 28, 2001 (the “Current Agreement”). The Current Agreement was most recently approved by the Board of Trustees at an in-person meeting held on September 28, 2004.

Section 15(a) also provides for the automatic termination of such agreements upon their assignment. An assignment is deemed to include any change of control of an investment adviser. Accordingly, the Current Agreement will terminate upon its assignment due to the proposed change in control resulting from the Transaction. In order for the New Adviser to be able to continue to provide investment management services to the Fund, shareholders must approve the New Agreement. A form of the New Agreement is attached to this Proxy Statement as Appendix A. The material terms of the Current Agreement and the New Agreement are described below.

- 3 -

Terms of the Current Agreement and the New Agreement

The terms of the New Agreement are identical to the terms of the Current Agreement, except for the dates of execution, effectiveness, termination and certain other non-material changes. The fees payable by the Fund to the Manager are identical in the Current and New Agreements.

On August 22 and September 7, 2005, the Board of Trustees met to consider the terms of the proposed Transaction, its effect on the Fund, and the proposed management of the Fund by the New Adviser under the New Agreement. The Trustees, including the Independent Trustees, approved, subject to shareholder approval described herein, the New Agreement between the Fund and the New Adviser. The Trustees recommend approval of the New Agreement by the shareholders of the Fund.

Subject to the control of the Trustees of the Trust, the Current Adviser continuously furnishes an investment program for the Fund and makes investment decisions on behalf of the Fund. The Current Adviser also manages, supervises and conducts the other affairs and business of the Fund, furnishes office space and equipment, provides bookkeeping and certain clerical services and pays all fees and expenses of the officers of the Fund.

Duties Under the New Agreement. Upon the completion of the proposed Transaction, and assuming shareholder approval of the New Agreement, the New Adviser will continue to provide these same services as are presently being provided to the Fund by the Current Adviser. Under the New Agreement, the New Adviser will: (i) furnish continuously an investment program for the Fund and will make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities, and (ii) manage, supervise and conduct the other affairs and business of the Fund, furnish office space and equipment, provide bookkeeping and clerical services, and pay all salaries, fees and expenses of the officers and Trustees of the Trust who are affiliated with the New Adviser. The New Adviser will discharge its responsibilities subject to the control of the Trustees and in a manner consistent with the Fund’s investment objectives, policies and limitations.

Duration and Termination. Upon the completion of the proposed Transaction, and assuming shareholder approval of the New Agreement, and unless terminated earlier, the New Agreement shall continue in effect as to the Fund through November 1, 2006 and thereafter for periods of one year for so long as such continuance is specifically approved at least annually: (i) by the vote of the holders of a majority of the outstanding shares of the Fund or (ii) by the vote of a majority of the Independent Trustees of the Trust, cast in person at a meeting called for the purpose of voting on such approval.

The New Agreement will terminate automatically in the event of its assignment. The New Agreement is terminable at any time without penalty by: (i) by the Trustees of the Trust; (ii) by a vote of a majority of the outstanding shares of the Fund; or (iii) on sixty (60) days’ written notice to the Manager or the Fund.

Compensation. Like the Current Agreement, under the New Agreement the New Adviser will receive a fee computed daily and paid monthly at the annual rate of 0.85% of the average daily net asset value of the Fund.

Limitations on Liability. Like the Current Agreement, the New Agreement provides that the New Adviser will not be liable for any act or omission in the course of, or connected with, rendering services under the agreement, but will be liable only for willful misfeasance, bad faith or gross negligence or reckless disregard of its obligations under the agreement.

Information About the Current Adviser and the New Adviser

The Current Adviser is located at 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814. The Current Adviser is owned by Mr. Torray, Mr. Eby and Mr. Lane. Robert E. Torray has served as President of the Current Adviser since it was organized in 1990. Mr. Torray is also the Chairman of Robert E. Torray & Co., Inc., a manager of large institutional portfolios that he founded on May 1, 1972, and the Chairman of TEL Corporation, Inc. a private investment fund manager that was founded on October 14, 2003, both of which are collectively owned by Mr. Torray, Mr. Eby and Mr. Lane. Douglas C. Eby, the Fund’s co-manager, joined the Current

- 4 -

Adviser in 1992. He serves as the Executive Vice President and is also President of Robert E. Torray & Co., Inc. and TEL Corporation. Mr. Torray is 68 and Mr. Eby is 46. As co-portfolio managers, Mr. Torray and Mr. Eby share equally in the day-to-day management of the Fund’s investment portfolio.

The Current Adviser provides investment advice and portfolio management services and oversees the administration of the Fund pursuant to the terms of the Current Agreement. The Current Agreement is dated as of June 29, 2001 and was last approved by shareholders of the Fund on June 29, 2001 when it was submitted to the vote of the then sole shareholder of the Fund in connection with the establishment and organization of the Fund. The Current Adviser received 0.85% of the Fund’s average daily net assets as compensation for these services for the fiscal year ended December 31, 2004, which amounted to $6,600,243. The Current Adviser also provides investment advice to The Torray Fund, which is another fund having similar investment objectives as the Fund. The Torray Fund requires a minimum investment of $10,000 and is intended as an investment vehicle for retail investors. The Current Adviser is entitled to receive a management fee from The Torray Fund at a rate equal to 1.00% of that fund’s average daily net assets. As of August 31, 2005, The Torray Fund had total assets of approximately $1.4 billion.

The Current Adviser is registered as an investment adviser with the Securities and Exchange Commission and as of August 31, 2005 had approximately $6.4 billion in assets under management.

The New Adviser will assume the day-to-day management and operations responsibility for the Fund. The New Adviser will continue to operate out of the offices presently occupied by the Current Adviser. Mr. Torray and Mr. Eby will be officers and employees of the New Adviser, as well as the New Adviser’s two largest equity holders, and they will continue to serve as the co-portfolio managers of the Fund in their capacities with the New Adviser.

Mr. Eby and Mr. Torray are each located at 7501 Wisconsin Avenue, Suite 1100, Bethesda, Maryland 20814. Markel Corporation is located at 4521 Highwoods Parkway, Glen Allen, Virginia 23060.

Shareholder Approval

The Proposal requires the affirmative vote of a “majority of the outstanding shares” of the Fund. The term “majority of outstanding shares,” as defined in the 1940 Act and as used in this Proxy Statement with respect to the Fund, means: the affirmative vote of the lesser of (1) 67% of the voting securities of the Fund present at the Special Meeting if more than 50% of the outstanding shares of the Fund are present in person or by proxy or (2) more than 50% of the outstanding shares of the Fund.

Factors Considered by the Trustees and their Recommendation

At their meetings on August 22 and September 7, 2005, the Trustees discussed and considered the New Agreement in light of the proposed Transaction. Among other things, the Trustees considered representations from the Current Adviser that it is anticipating no material changes to the management and operation of the Fund after the Transaction and that the personnel currently responsible for the investment management of the Fund are intended to continue serving in their respective roles. In connection with this, the Trustees placed particular emphasis on the fact that Mr. Torray and Mr. Eby will continue to serve as the co-portfolio managers of the Fund as employees of the New Adviser and, in addition, that Mr. Torray and Mr. Eby will enter into long-term employment agreements with the New Adviser. The Trustees also considered representations from the Current Adviser that motivating factors for the Transaction are an effort to create a succession plan that ensures the Current Adviser and its affiliated entities remain independent and the estate planning objectives of Mr. Torray. The Trustees also considered that the material terms and conditions and the fees payable under the Current Agreement are not scheduled to be changed under the New Agreement.

Among the factors the Board considered was the overall performance of the Fund achieved by the Current Adviser relative to the performance of other mutual funds with similar investment objectives on both a long term basis and

- 5 -

over shorter time periods. In particular, the Board took note of the favorable performance achieved by the Current Adviser for the period since the inception of the Fund and they considered the Current Adviser’s particular focus on long-term investment performance, noting that the Fund has outperformed its applicable benchmark index, the S&P 500 Index, for the period since inception of the Fund. The Trustees indicated that they wished to retain the services of the New Adviser in order to maintain the services of the team that has been responsible for the Fund’s performance. They noted the range of investment advisory and management services provided by the Current Adviser and the level and quality of these services, and in particular, they noted the quality of the personnel providing these services, taking into consideration their finding that the personnel providing these services, and the services provided, are of a very high caliber and quality, and they took into consideration the fact that the personnel providing these services are not expected to change as a result of the contemplated Transaction. The Board also compared expenses of the Fund to the expenses of other funds of similar size, noting that the expenses for the Fund following the completion of the Transaction are expected to continue to compare favorably with industry averages for funds of similar size. They also took note of the fact that the Fund is not presently subject to any sales loads, sales commissions or other similar fees, including Rule 12b-1 distribution fees, which helps to keep the overall expense to shareholders of investing in the Fund lower than the expenses associated with investing in many comparable funds, and they considered the fact that the New Adviser has informed the Board that it does not intend to propose the introduction of such types of fees to the Fund. The Board also reviewed financial information concerning the Current Adviser and the New Adviser, noting the financial soundness of each as demonstrated by the financial information provided.

In addition, the Board reviewed with the Current Adviser information regarding its brokerage practices, including soft dollar matters, which the Current Adviser does not have any agreements to do, and its best execution procedures, which the Board noted were reasonable and consistent with standard industry practice, and the Board was informed by the New Adviser that it intends to continue to follow these same brokerage practices.

Based on this review, and in light of the terms of the contemplated Transaction, the Trustees concluded that the management services contemplated under the New Agreement are reasonably worth the full amount of the fee, plus any benefits that incidentally may accrue to the New Adviser, and that the terms of the New Agreement are fair and reasonable. Accordingly, the Trustees, including a majority of the Independent Trustees, approved the New Agreement and voted to recommend its approval by the shareholders of the Fund.